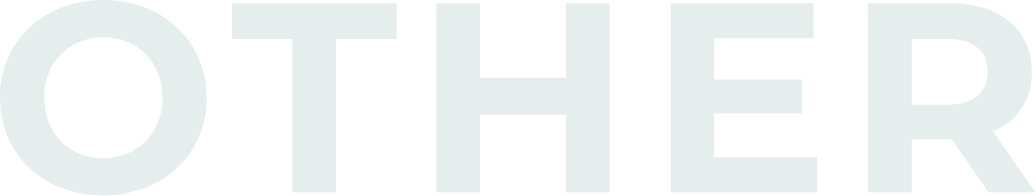

Economic losses from natural disasters increase year by year

We deem it our social responsibility to maintain and sustain insurance underwriting against contingencies such as natural disasters.

Climate change poses a top-level risk to the entire world. Economic losses caused by natural disasters, such as hurricanes, floods, droughts and wildfires, have been increasing on a long-term basis. For 2020, economic losses caused by disasters are estimated to total 202 billion US dollars, of which the loss of 190 billion dollars is attributable to natural disasters.

The momentum for carbon neutrality has been expanding globally, but even if we can truly go carbon neutral by 2050, the global average temperature will still rise from the present level, further increasing the frequency of natural disasters.

Amid such dire circumstances, we have a social responsibility to provide insurance services, including those against natural disasters. In order to deliver safety and a sense of security to customers as an insurer, we regard the solution of climate change as our top priority. We believe that it is important to realize the sustainability of our company and society at the same time.

The momentum for carbon neutrality has been expanding globally, but even if we can truly go carbon neutral by 2050, the global average temperature will still rise from the present level, further increasing the frequency of natural disasters.

Amid such dire circumstances, we have a social responsibility to provide insurance services, including those against natural disasters. In order to deliver safety and a sense of security to customers as an insurer, we regard the solution of climate change as our top priority. We believe that it is important to realize the sustainability of our company and society at the same time.

Chart: Sigma No 1/2021 p24 Quoted from Figure 15 Insurance damages due to disasters from 1970 to 2020

Source: Swiss Re Institute

Source: Swiss Re Institute

- You are here

- Home>Corporate Information>Sustainability>Climate Change

Facing the risks posed by Climate Change

News Release

-

~Supporting Efficient Subsea Cable Inspections~ Developed an Underwater Drone Inspection Service for Offshore Wind Power Facilities (in Japanese only)

Notice

-

~Supporting client’s financial losses from unusual weather events~ Launch of the Weather Index-based Insurance (in Japanese only)

Notice

-

~Promoting the Spread of Solar Power and the Achievement of a Decarbonized Society~ Launch of Cable Theft Prevention Service for Solar Power Operators (in Japanese only)

Notice

-

~Transition to 2050 Net Zero~ Progress in Reducing Greenhouse Gas (GHG) Emissions from Insurance Underwriting and Investments

Notice

-

~Transition to 2050 Net Zero~ Interim Targets for Greenhouse Gas (GHG) Emissions from Insurance Underwriting and Investments

Notice

-

Mitsui Sumitomo Insurance received the Minister of the Environment Award (Silver Award) of the “Ministry of the Environment’s 4th ESG Finance Awards Japan.” (in Japanese only)

Notice

-

We set the “MS Green Index” to indicate our progress with the measures to achieve net-zero emissions by2050. (in Japanese only)

Notice

Things that we can do against Climate Change

Torrential rains and floods, which used to happen only once in several decades, now occur almost every year. Moreover, typhoons, forest fires, droughts, heat waves, rising sea levels and other phenomena that are thought to have been caused by climate change are hitting regions across the world with greater intensity.

Global warming is said to be causing these global weather disasters, and scientific evidence indicates that global warming is indisputably attributable to human activities.

In the face of climate change, people are required to reform their lifestyles and companies their management styles.

If we consume natural resources without limit for economic activities or pursue development activities that exploit nature to excess, deforestation, loss of biodiversity and damage to water resources will be the result. These social issues are interrelated, and we need to address them in a concurrent manner.

Reasons Why We Are Implementing Climate Change Countermeasures

For the sustainable provision of services as an insurer

Non-life insurance provides vital support to society and the economy.

Climate change has a tremendous impact on the sustainability of the non-life insurance business itself and is thus an issue that we are addressing as our top priority.

Climate change has a tremendous impact on the sustainability of the non-life insurance business itself and is thus an issue that we are addressing as our top priority.

Measures to Address and Solve

Issues Related to Climate Change,

Natural Capital and Biodiversity

Issues Related to Climate Change,

Natural Capital and Biodiversity

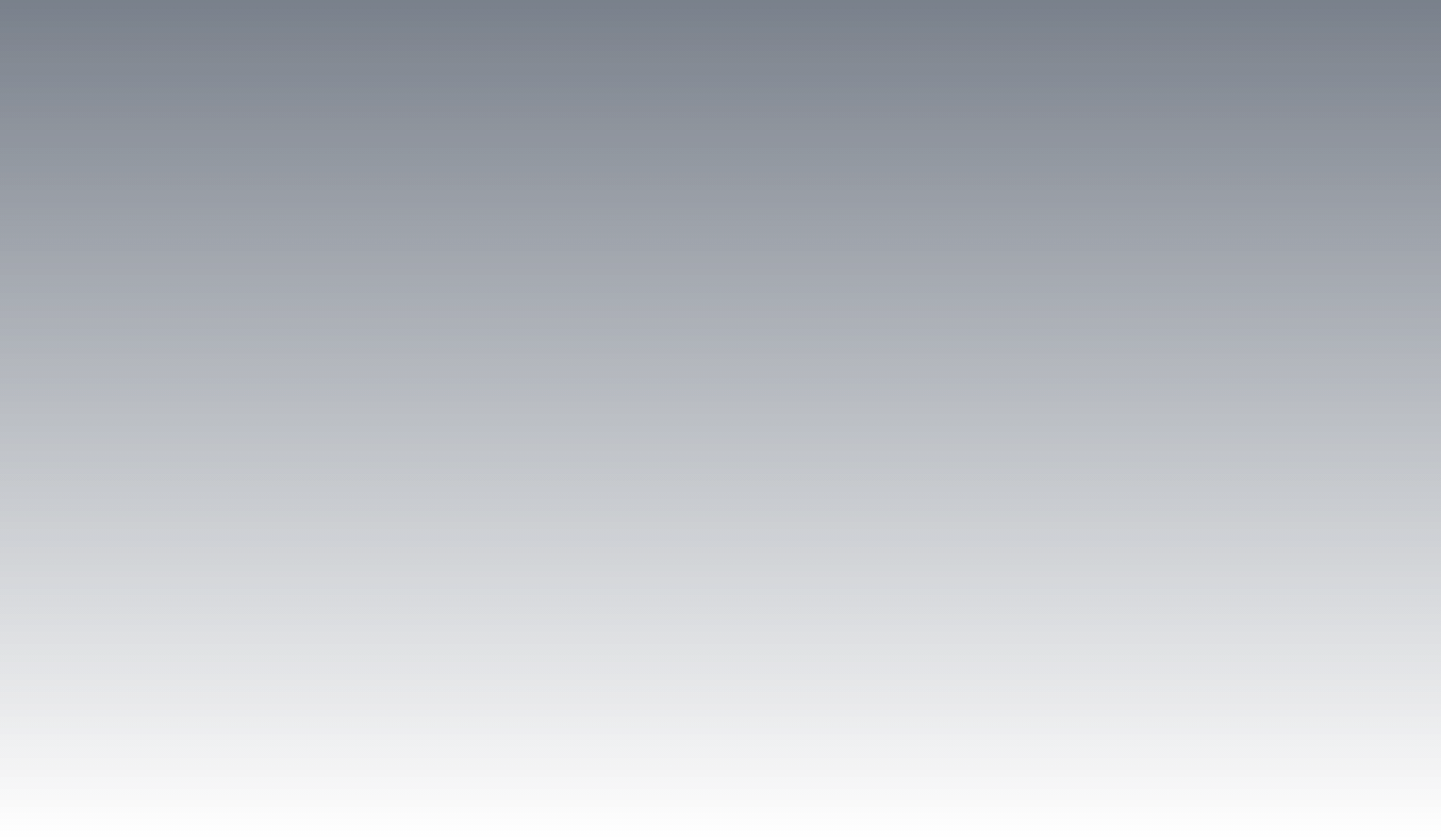

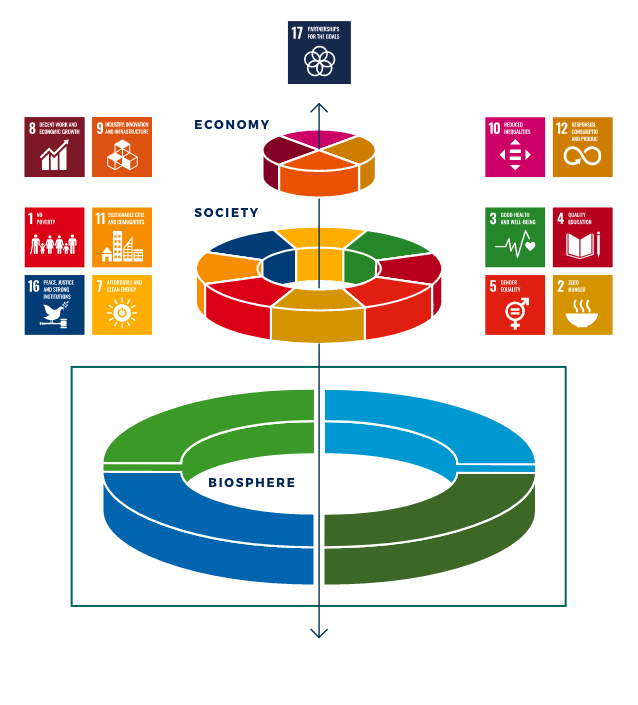

The Sustainable Development Goals (SDGs) include a range of goals, such as eradicating poverty and hunger, the achievement of gender equality and sustainable economic growth. It can be said that the establishment of a stable climate system and a sound natural environment will provide a foundation for their achievement.

Mitsui Sumitomo Insurance is committed to supporting a transition to a decarbonized society (for climate change mitigation) as a financial institution and is also committed to reducing social losses caused by climate change (for climate change adaptation) as a non-life insurance company.

Climatic stability is supported by sound ecosystems that maintain biodiversity.

The loss of abundant forests and oceans not only reduces the absorption of greenhouse gases, but also causes further damage to the natural environment due to extreme weather events such as heat waves and droughts. In view of this, it is necessary to consider climate change and the natural environment as one.

For the realization of a resilient and sustainable society, Mitsui Sumitomo Insurance is implementing measures to protect and recover natural capital and biodiversity while also fostering measures against climate change.

The SDGs wedding cake

Azote for Stockholm Resilience

Centre, Stockholm University

Azote for Stockholm Resilience

Centre, Stockholm University

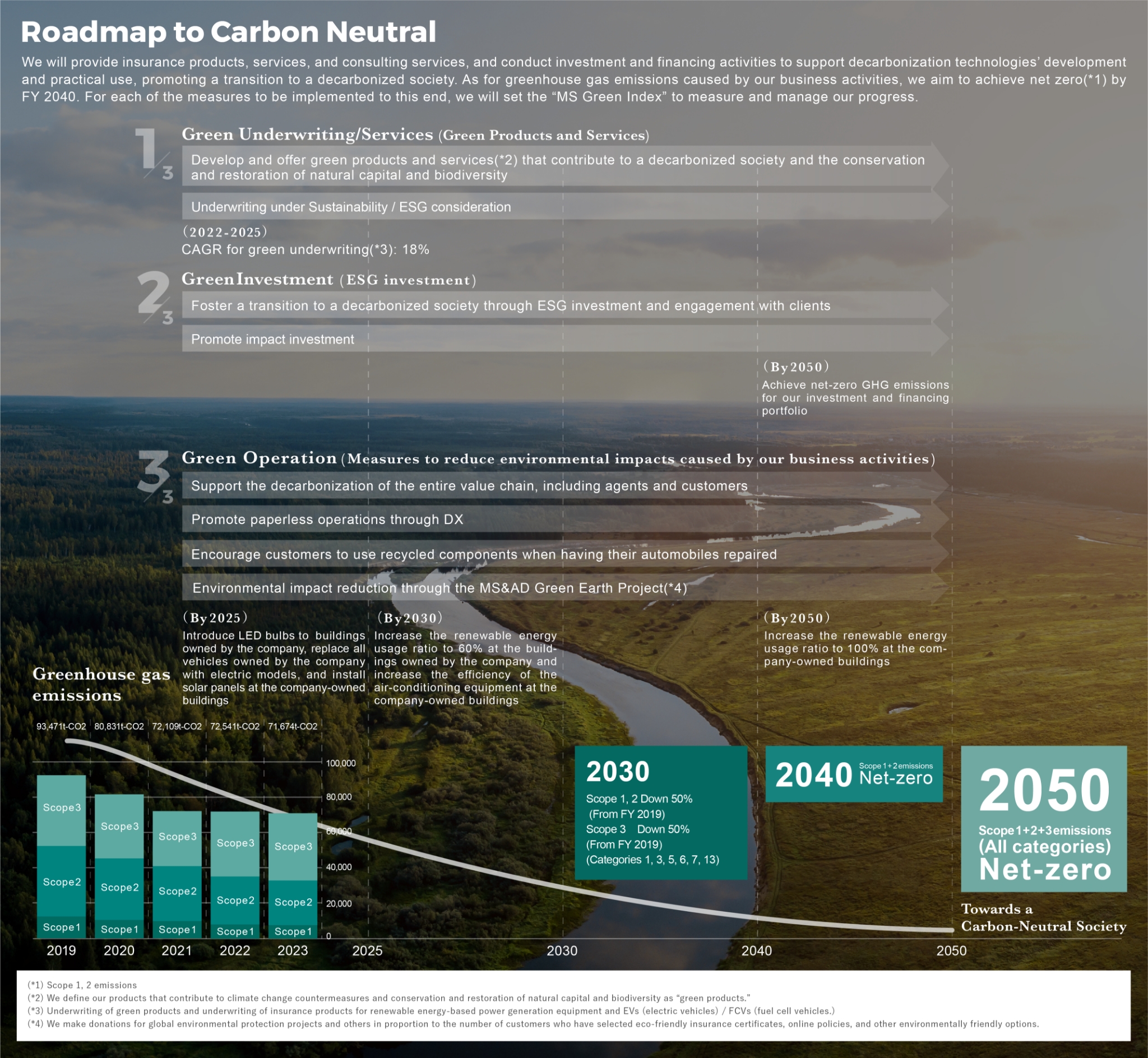

Towards a Carbon Neutral Society

Mitsui Sumitomo Insurance addresses the risks posed by climate change to the economy and society and supports a transition to a decarbonized economy, which is our purpose.

We will provide products and services that contribute to a transition to a decarbonized society, reduce greenhouse gas emissions across our investment and financing portfolio, and are committed to achieving net-zero for greenhouse gas emissions caused by our business activities by FY 2040.

MS Green Index

Progress with Related Measures

Progress with Related Measures

We set the MS Green Index to indicate our progress with the measures to achieve net-zero emissions by 2050, specifically those related to insurance underwriting, investment and financing activities, and our business operations.

Green Underwriting/Services

(Green Products and Services)

(Green Products and Services)

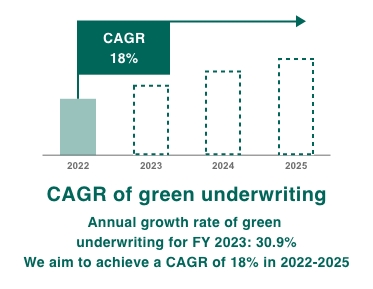

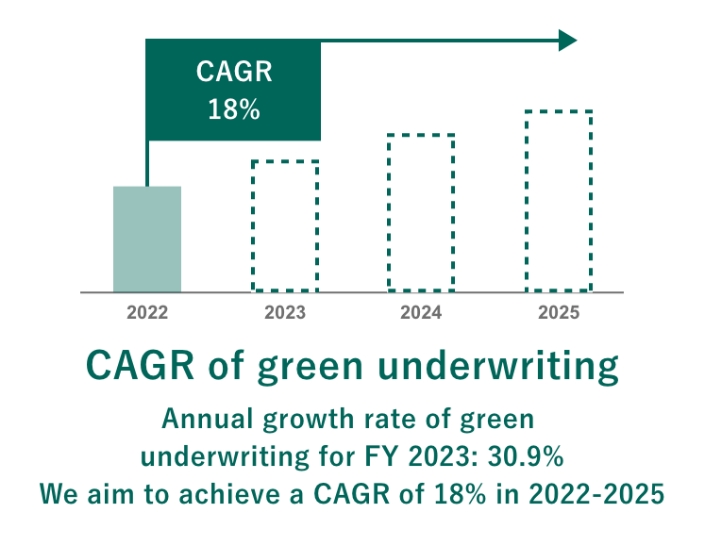

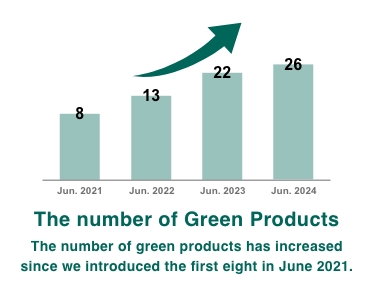

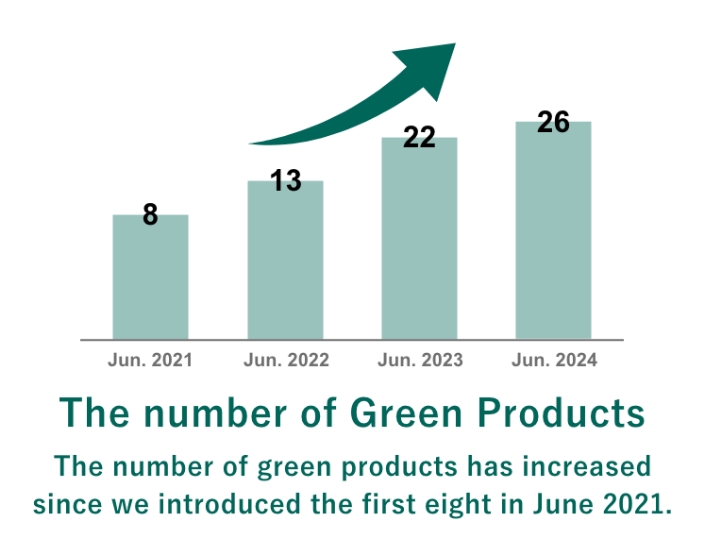

As our mission as a non-life insurance company, we will develop insurance products (“green products”) that contribute to the decarbonization of society and conservation and restoration of natural capital and biodiversity and will also provide products for renewable energy-based power generation equipment and electric models, such as electric vehicle (EVs) and fuel cell vehicles (FCVs) (“green underwriting”) for the creation of a carbon neutral economy, while also achieving our own sustainable growth and increasing our corporate value. For green products, we will expand the lineup and for green underwriting we aim to achieve CAGR of 18%.

To promote the spread of

renewable energy

-

Comprehensive coverage plan for mega-solar power generation plants

-

Comprehensive coverage for offshore wind power generation systems

-

Comprehensive small wind power coverage plan

-

Comprehensive coverage plan for biomass power plants

-

Comprehensive coverage plan for geothermal power generation facilities

-

Comprehensive coverage plan for small and medium-sized hydroelectric power plants

- Insurance to support the stable supply of Green Power Certificates (in Japanese only)

- Insurance for sympathy money payment by PPA operators to neighborhood victims (in Japanese only)

- Imbalance risk compensation insurance (in Japanese only)

Support for transition to a

decarbonized society and

disaster recovery assistance

- Carbon neutral support clause for corporate property insurance

- EV charging equipment damage coverage special clause (in Japanese only)

- EV automobile replacement support special clause (in Japanese only)

-

Comprehensive coverage plan for hydrogen stations

- Rental car cost rider special clause in case of hydrogen station failure (in Japanese only)

- Environmental contamination liability coverage for CCS operators (in Japanese only)

-

Insurance to support municipal PPS

- Insurance to support natural disaster response (in Japanese only)

- Rental car cost rider special clause for the electric vehicle, etc., based on a disaster assistance agreement (in Japanese only)

- Special clause coverage for clothing recycling expenses (in Japanese only)

-

Coverage for carbon credit expenses

- J-Credit compensation insurance (in Japanese only)

- Low-energy house special clause (in Japanese only)

Conservation and restoration of

natural capital and biodiversity

- Marine contamination special clause coverage for additional expenses (in Japanese only)

- Expanded special clause coverage for contamination damage (in Japanese only)

- Special clause coverage for reforestation expenses, etc. (in Japanese only)

- Package for supporting corporate green space initiatives (in Japanese only)

-

Coverage for the environmental pollution response

- Food Waste Reduction Endorsement for inland marine insurance subscribers (in Japanese only)

Green Investment

(ESG investment)

(ESG investment)

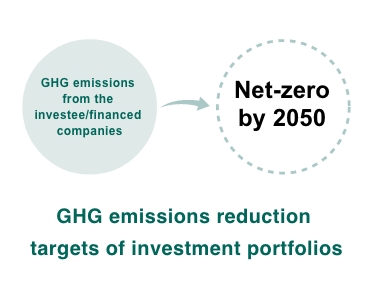

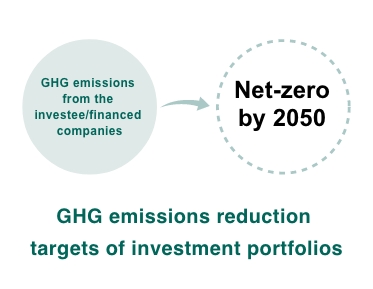

By 2050 we will achieve net-zero GHG emissions for all investment portfolios. Through investment and financing, we will support companies that are embracing the challenge of developing innovative technologies for the substantial reduction of GHG emissions. Also, based on constructive dialogues with the investee companies, we will work with them to foster a transition to a decarbonized society. Furthermore, by promoting impact investment, we will contribute to the achievement of the SDGs and the creation of a sustainable society.

-

MS&AD INSURANCE GROUP INVESTS IN IMPACT FUNDS(December 14, 2021)

MS&AD INSURANCE GROUP INVESTS IN IMPACT FUNDS(March 5, 2025)(in Japanese only)

Investment in a Forestry Fund to Contribute to Achieving SDGs (in Japanese only)

Investment in a Venture Fund by Energy & Environment Investment, Inc. (in Japanese only)

-

For investment and financing in consideration of ESG issues, we are implementing measures in line with the policy set by MS&AD Insurance Group Holdings.MS&AD Insurance Group Holdings: ESG integration and sustainability approach

-

For the Principles for Responsible Institutional Investors (Japan’s Stewardship Code), we have announced that we agree with the purport and accept the principles.Japan’s Stewardship Code

Green Operation

(Environmental impact reduction measures in our business activities)

(Environmental impact reduction measures in our business activities)

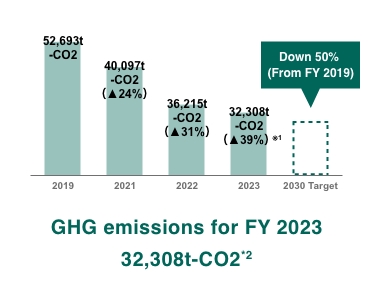

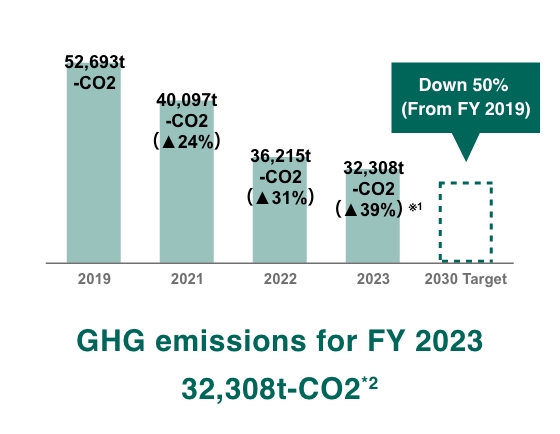

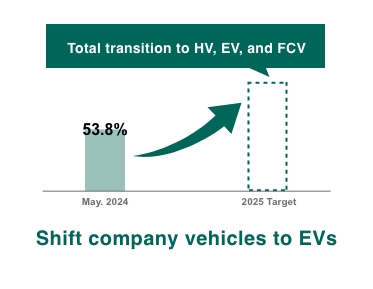

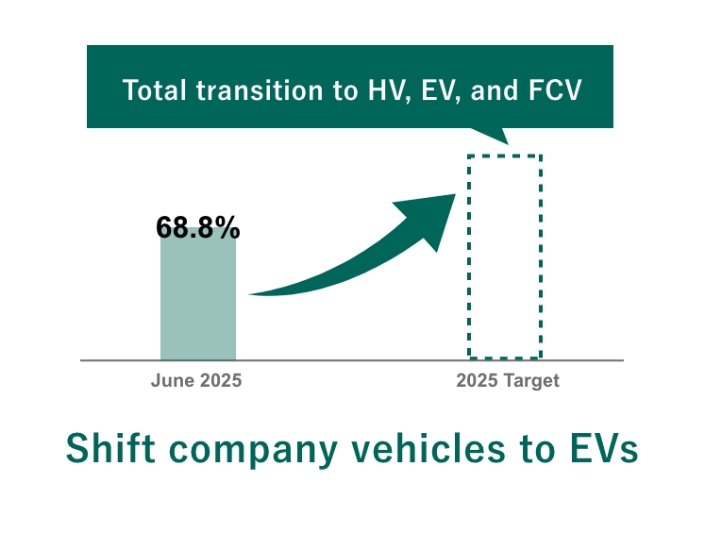

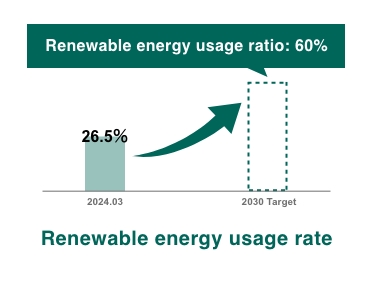

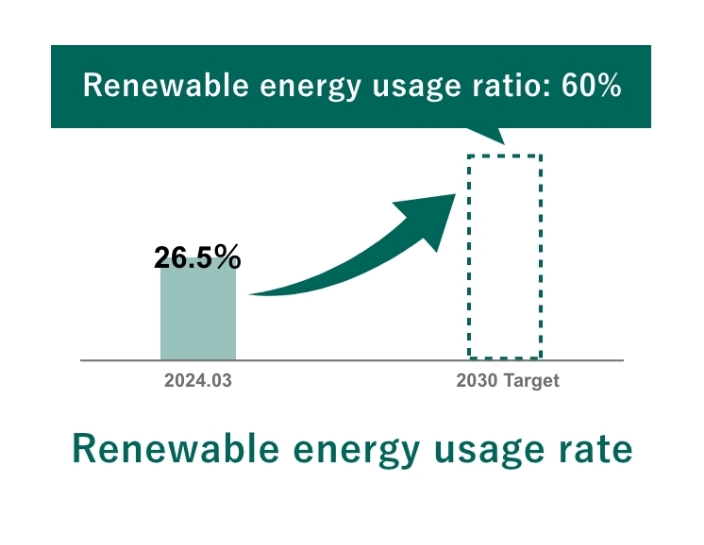

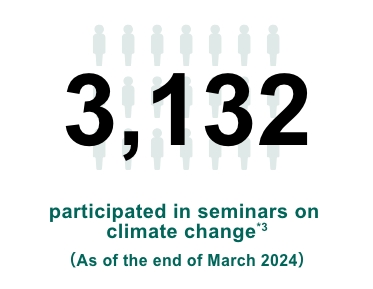

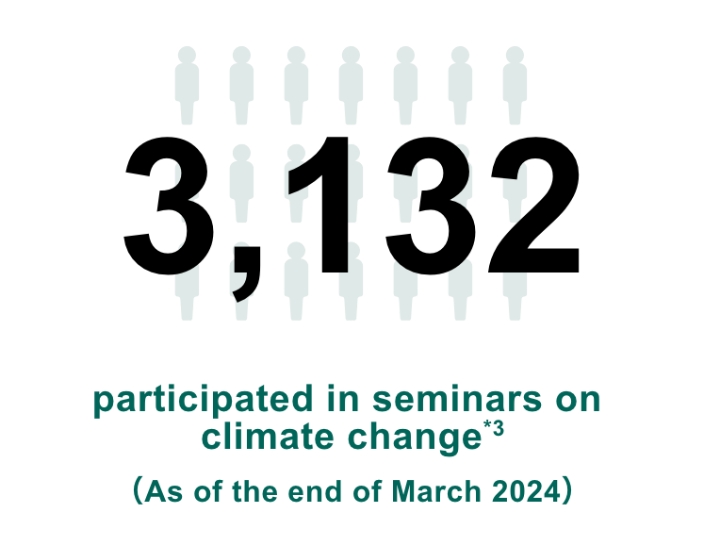

We will achieve net-zero for greenhouse gas emissions caused by our business activities (Scope 1 + 2 emissions) by FY 2040 and will also achieve net-zero for Scope 1 + 2 + 3 emissions by FY 2050. In order to attain these targets, we have set an interim target for FY 2030, which is to reduce the emissions by 50% compared to FY 2019 levels. For the creation of a carbon neutral society, we also need to reduce CO2 emissions across the value chain. Accordingly, we will work with our customers, agents and other stakeholders for emissions reduction. Moreover, we will enhance climate change-related training for employees to help them increase their awareness about the importance of fostering decarbonization.

- Scope1+2 ▲43%

Scope3 (1,3,5,6,7,13) ▲5% - Scope1+2

- (※3) The number represents participants of our internal seminar and an online course titled “Climate Change and Business Design” offered by “MS&AD Digital Academy,” our training program created in collaboration with Toyo University Faculty of Information Networking for Innovation and Design (INIAD).

MS&AD Holdings

MS&AD Green Earth Project